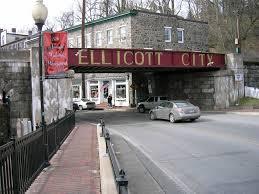

Ellicott City, Maryland Personal Loan Companies

9450 Baltimore National Pike

Ellicott City, MD 21042

(443) 973-3070

Hours: M-Th 9am-5pm, F 9am-6pm, S 9am-12pm, Sn Closed

9151 Baltimore National Pike

Ellicott City, MD 21042

(410) 418-8500

Hours: M-Th 9am-5pm, F 9am-6pm, S 9am-2pm, Sn Closed

3458 Ellicott Center Drive Suite 106

Ellicott City, MD 21043

(410) 461-2257

Hours: M-F 9am-5pm, S-Sn Closed

9125 Baltimore National Pike

Ellicott City, MD 21042

(410) 465-8941

Hours: M-Th 9am-5pm, F 9am-6pm, S 9am-1pm, Sn Closed

4715 Dorsey Hall Drive

Ellicott City, MD 21043

(410) 730-8318

Hours: M-F 11am-7:30pm, S 9am-5:30pm, Sn 11am-4pm

10000 Baltimore National Pike

Ellicott City, MD 21042

(443) 973-3543

Hours: M-F 10am-7pm, S 10am-4pm, Sn 1pm-5pm

9150 Baltimore National Pike

Ellicott City, MD 21042

(800) 787-8328

Hours: M-F 10am-5:30pm, S 9am-2pm, Sn Closed

9230 Baltimore National Pike

Ellicott City, MD 21042

(410) 750-1306

Hours: M-Th 9am-5pm, F 9am-6pm, S 9am-2pm, Sn Closed